When To Use Conjoint Analysis [5 Criteria & 10 Examples]

Conjoint analysis is, without a doubt, one of the most misused and misunderstood research methods.

At least once a fortnight, I find someone online asking about using conjoint analysis for a project that does not need or suit conjoint. They’ve usually heard that conjoint analysis is used for simulating trade-offs, so they assume it’s generally suitable for understanding people’s priorities in any research scenario. But conjoint is a very niche form of trade-off analysis used specifically to simulate purchase scenarios to understand attribute importance within a product mix — that’s literally the one thing that conjoint is designed for!

So next time you’re asked whether conjoint is the right research method to use, send them this blog post. It covers (1) an understandable explanation of what conjoint analysis actually is, (2) five criteria your research project must meet to consider using conjoint, (3) three scenarios that conjoint analysis is suited to, and (4) ten common research scenarios that should NOT use conjoint analysis.

Let’s dive in…

What is Conjoint Analysis?

Conjoint analysis is a survey format that measures the importance of specific product attributes (like price, brand, or features) when a potential customer is comparing options in a purchase decision.

Conjoint analysis assumes that people evaluate products based on their combination of attributes. The result of a conjoint survey tells you the relative importance of each attribute (eg. whether price or brand are more important) as well as a ranking of the options within each attribute (eg. for brand whether people are more likely to go for Coca-Cola or Pepsi).

— — —

What Does A Conjoint Analysis Survey Look Like?

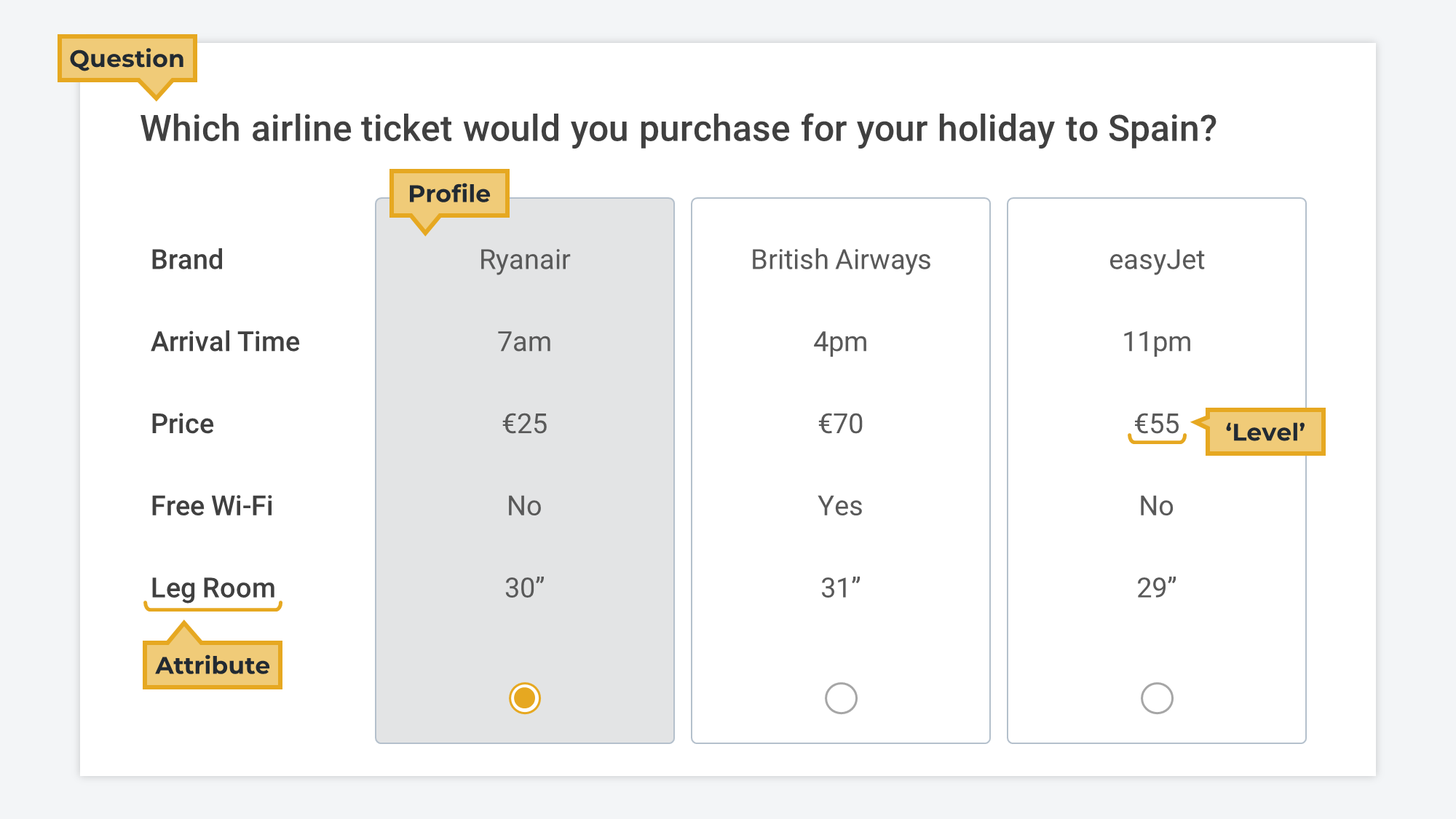

A conjoint survey shows two or more product “profiles” that represent variations of the same product. Each profile has the same list of attribute categories, but the options shown for those categories vary on each profile. When a respondent picks their preferred profile, their vote is recorded and a new set of profiles are shown.

Four Components Of A Conjoint Analysis Survey

Question: Gives the respondent context about the product decision they are simulating.

Profile: A complete set of attribute values that make up a potential product offering.

Attributes: The characteristics relevant to a customer’s purchase decision (aka “categories”).

Levels: The range of values or possibilities you include within each attribute (aka “options”).

— — —

Interactive Demo of a Conjoint Survey

Below you’ll find a simple conjoint survey with just two profiles showing at a time. If you complete the survey, it will automatically open the results afterwards so that you can see how everyone has voted so far. This demo is taken from my guide reviewing the 10 most popular conjoint analysis tools (this survey was created on OpinionX).

⬆️ interactive demo survey created on OpinionX

Create your own conjoint analysis survey for free on OpinionX, which is a free research tool used by tens of thousands of teams to measure what matters most to their customers. You can create unlimited conjoint analysis surveys for free on OpinionX and each survey can engage unlimited participants for free too!

— — —

Example Conjoint Analysis Research Project

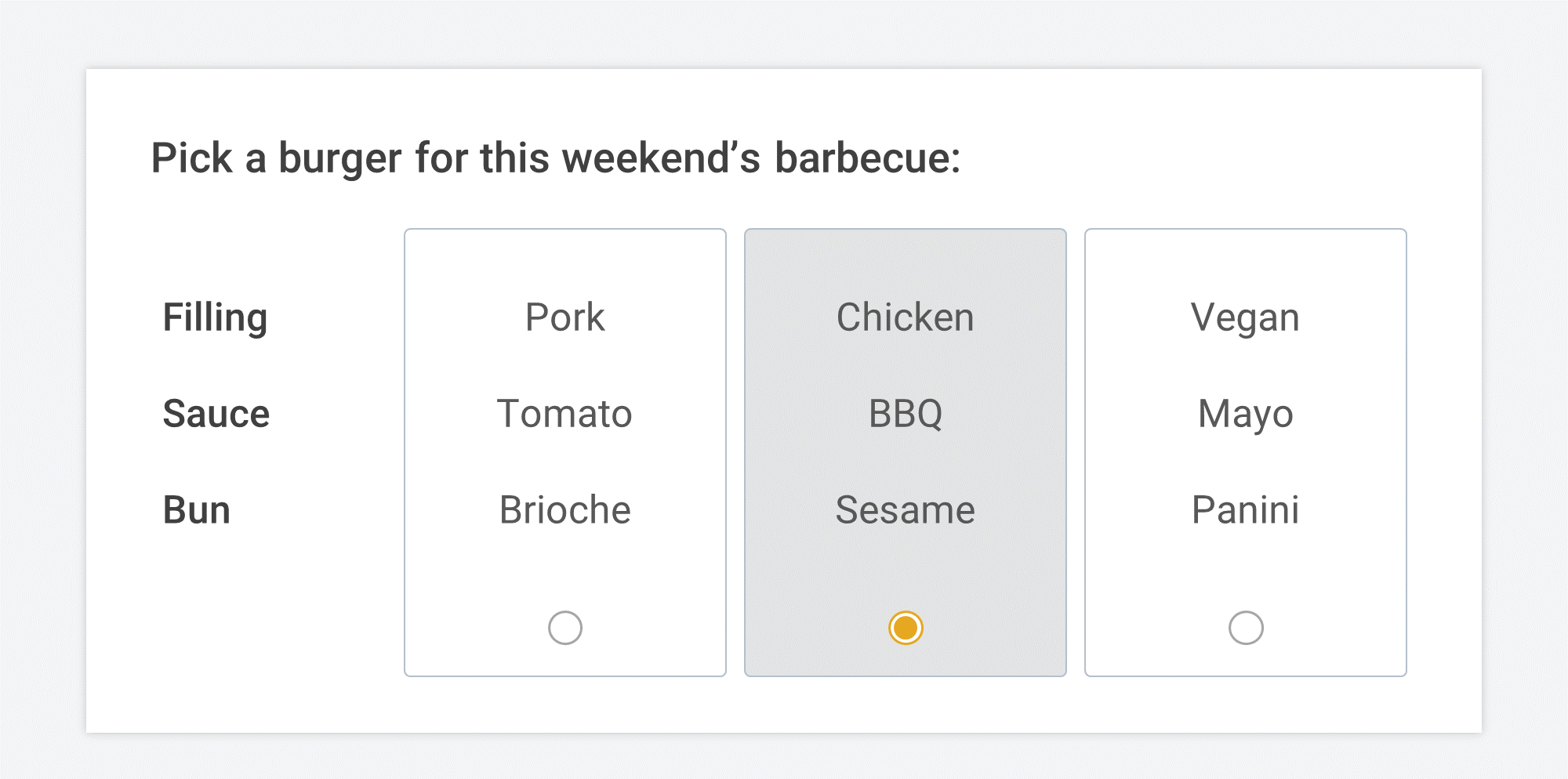

You’re running a conjoint survey to decide what burger to prepare for your weekend barbecue. You pick three burger attributes: filling, sauce, and bun type. Each attribute has four ’levels’ — for burger fillings, you decide to include pork, chicken, vegan, and beef options.

Our barbecue conjoint can help us answer questions like:

1. Within the overall burger, which attributes are most important to people? Is the choice of filling more important than the sauce? Is the sauce more important than the bun type?

2. Within each attribute, which ’levels’ have the highest relative importance to people? For the filling, will people be more interested in having our burgers if we switch the pork filling to a chicken, beef or vegan patty instead?

Conjoint Analysis Results — Relative Importance of Attributes (left) and Levels (right)

Our results show that:

When people make decisions about which burger they want, 50% of their decision is based on the filling. In comparison, the bun only accounted for 10% of people’s preferences.

Beef and chicken were the two most popular fillings.

— — —

5 Criteria Required For Using Conjoint Analysis

Conjoint analysis simulates a purchase decision where a customer compares a set of similar products. It takes a very rational view that customers decide which product is their favorite by comparing individual attributes in a product like price, brand, and features, and combine these together to create an interpreted value that can be compared against other products.

This is quite a sterile interpretation of purchase decisions which misses many important factors and makes the research method only really suited to scenarios where:

You’re simulating a simple, well-considered purchase between similar products.

Where only one person is involved in the purchase decision.

Where the customer already knows what kind of product they need.

Where you know which attributes the customer uses to compare products.

Where those attributes have no overlap in meaning or possible options.

These are very specific requirements because conjoint is a very specific research format! Plenty of other research methods also model people’s preferences using forced trade-offs but with way more flexibility than a hypothetical purchase scenario.

— — —

3 Research Projects Suited To Conjoint Analysis

(i) Calculating Willingness-to-Pay For Existing Features

Conjoint analysis produces data called “utility scores”, which are used to understand the relative importance of each attribute or level. If one of our attributes was price, we can convert the utility scores to a currency equivalent to figure out how many dollars equals one utility unit. This can be used to understand how much more your customers are willing to pay for some attributes or levels compared to others. However, you need existing price estimates for conjoint surveys meaning it’s only suitable for existing products. If you have no starting point for pricing, try a Van Westendorp survey instead.

(ii) Assembling The Optimal Product Mix / Bundling Strategy

You can use the ‘willingness-to-pay’ data to build your product mix, but an alternative approach to consider is called TURF — an analysis method applied on top of conjoint data to determine the optimal attribute mix for your product. TURF stands for Total Unduplicated Reach and Frequency Analysis, ie. what combination of features will reach the highest number of consumers while achieving a desirable level of market saturation (frequency). Conjoint has already mapped people’s preferences towards product attributes, so TURF matches options up based on which ones have the highest combined preference that will appeal to the most people possible.

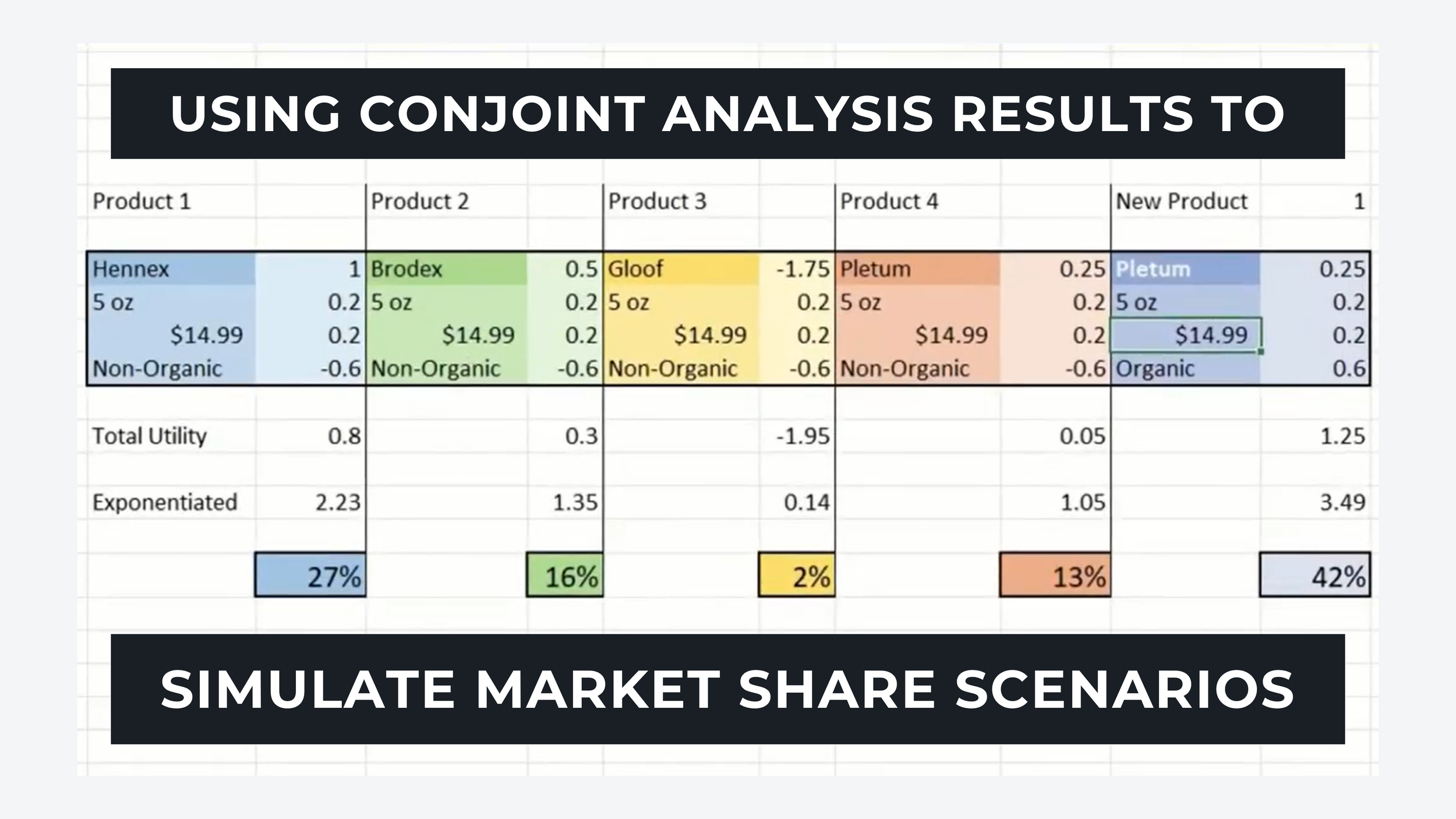

(iii) Modelling Market Share Scenarios

You can also use utility scores to simulate market scenarios to understand which product attribute choices would produce the largest market share for your concept product compared to competitors. Jump to 2:57 in the video for a great example of conjoint results being used to simulate market share scenarios.

10 Research Scenarios Where You Should NOT Use Conjoint Analysis

1. Simple Trade-Offs ❌

Most times, conjoint is complete overkill, because you’re just trying to rank a set of options based on which are most important to your customers/colleagues. You can accomplish this far easier with research methods like pairwise comparison, rank ordering, or points allocation. No need to spend $1000+ on a conjoint tool and $2500+ for a conjoint specialist agency to help you with setup and analysis — just pick a more suitable choice-based ranking method!

2. One Category ❌

In this example from Reddit, a HR manager asks about using conjoint to plan their employee benefits program. But conjoint requires “attribute” categories, so they’ll have to split benefits into categories like wellness, healthcare, and professional development. What they don’t realize is that, at the end of their research, conjoint won’t let them compare benefits they’ve put into separate categories. They’ll have spent a lot of time and money to get inconclusive data that doesn’t answer their original question.

3. Impulse Purchases ❌

Conjoint uses a very rational approach that assumes people compare products against alternatives before buying. This isn’t always how people make purchases, especially for “impulse” buys like consumer goods, stuff that’s on sale, or products bought directly through online ads where no “considered comparison” against alternatives takes place.

4. Complex Purchases ❌

Conjoint doesn’t simulate complex purchases well, like buying B2B software where it’s difficult to directly compare product attributes or where multiple stakeholders are involved (eg. when the buyer and end-user are different people).

5. Intangible Attributes ❌

Conjoint measures the relative importance of tangible attributes like brand, price, and quality. Many purchase decisions — especially for B2B products — are driven by intangibles like the customer’s need, pain or desire. Conjoint focuses on things like features and capabilities at the expense of understanding the true drivers of buyer motivation. A better approach to understanding intangible attributes is customer problem stack ranking.

6. No Benchmark Price ❌

Conjoint is probably most famous for its use in pricing research. But what people often misunderstand is that conjoint tests pricing rather than creates pricing. This means you need 2-7 potential price points to create a conjoint survey in the first place. If you’re starting from zero to figure out what ballpark price you should consider, conjoint will force you to pick estimates that may be way off what’s actually best for your product. In scenarios with no benchmark price, you’re better off starting with a Van Westendorp survey instead.

7. Emerging Opportunity ❌

Designing a conjoint survey correctly is really tricky, particularly defining attribute categories and their levels. You need 2-7 attribute groups with 2-7 ‘levels’ in each attribute. Every attribute must meet criteria like MECE (Mutually Exclusive and Collectively Exhaustive), unidimensionality (each attribute should represent a single dimension of variation in consumer preferences), and salience (attributes must be guaranteed factors through which customers compare competitive alternatives). You need a very well-understood product space to use conjoint analysis. It’s not suitable for emerging product categories or innovations where the attributes customers use to compare products have not been well defined and researched.

8. New Features ❌

If the market hasn’t seen a feature yet, it’s unlikely you can explain it in under 5 words (there’s a 20-30 character limit for conjoint ‘levels’). Every respondent will likely interpret your feature idea differently, creating messy, inconclusive results. And anyway, conjoint analysis simulates a purchase scenario — that’s not how you should be prioritizing your product roadmap! Instead, use an approach like customer problem stack ranking to identify the problems your customers perceive to be the highest priority to solve next.

9. Attribute Quantity ❌

Conjoint is a very fixed survey format. You must have 2-7 attribute categories and 2-7 options (’levels’) per attribute. Many researchers have more/less than that but force their research into the conjoint format, even when it isn’t the right fit for you. However, there are plenty of other ways to do comparison-based ranking, including formats for ranking a long list of options, so don’t let the rigid requirements of conjoint stop you.

10. Relationship Complexity ❌

Conjoint was designed for simulating purchase comparisons between physical products in the 1970s and 80s. For many software products today, it’s not easy to split feature capabilities into neat categories like battery life, storage space, and packaging color. The features in software products have complex, interdependent relationships that make them hard to isolate and explain in just 20-30 characters. Especially in B2B software, it’s difficult to accomplish this while also ensuring attributes and levels meet criteria like MECE, unidimensionality, and salience.

— — —

Conclusion: Conjoint Is Powerful (If Used Correctly)

The most common mistake I see is that conjoint encourages you to put options into separate attributes that can’t be directly compared at the end of your research. You can avoid this by (i) hiring a conjoint analysis specialist, (ii) understanding when not to consider conjoint analysis, and (iii) knowing more about the alternative research methods for modeling trade-offs and understanding people’s priorities.

— — —

Create Your Own Conjoint Analysis Survey For Free

Ready to start your own Conjoint Analysis research? You can create unlimited conjoint surveys with no participant limits for free on OpinionX, a research tool used by tens of thousands of teams at companies like Google and Microsoft to measure what their customers care about most

— — —

Additional Reading About Conjoint Analysis

• Ultimate Guide to Conjoint Analysis (Explanation, Tools, Types, Examples, and more)

• 7 Alternatives To Conjoint Analysis For Trade-Off Research

• 10 Most Popular Tools For Conjoint Analysis (Free vs Paid)

About The Author:

Daniel Kyne is the Co-Founder of OpinionX, a free research tool for stack ranking people’s priorities — used by tens of thousands of teams to better understand what matters most to their customers.

If you enjoyed this post, subscribe to our newsletter The Full-Stack Researcher, where we share more actionable user research advice and strategies with thousands of product teams and founders around the world: