Needs-Based Segmentation: A Step-by-Step Guide For Startups

Every founder, investor and startup ‘expert’ talks about the importance of picking a target customer segment and solving a burning unmet need, but beyond telling you to “Go talk to your customers,” they offer no practical advice on how to actually do this.

In university we’re told that ‘finding an unmet need and identifying the group of people who feel this need most acutely’ is called Needs-Based Segmentation. The problem with Needs-Based Segmentation is that — outside of advanced (and extremely expensive) market research agencies — nobody really knows how to do needs-based segmentation. Almost every article you can find on Google just offers a similar vague definition and the same image of some dots grouped by color.

Over the past 2 years, I’ve helped hundreds of organizations — from scaling startups and global tech companies to governments and non-profits — to design and run data-driven research projects that identify the highest priority needs of specific groups of people. I use the same simple set of steps for almost every single project, which I’m going to outline in this article.

The two key questions that I’ll focus on, which all those other articles fail to answer, are:

How do you find out what people’s most important needs are, using real quantitative data?

How do you then use that data on user needs to create segments that are actionable for your business?

Note: I’m the co-founder of a startup called OpinionX, which is a research tool that helps you to discover and rank people’s needs. While this post is based on the learnings I’ve gathered growing OpinionX to a userbase of over 1,000 teams around the world, you’re welcome to take my recommendations and apply them in any manner or on any tool of your choosing.

What is Needs-Based Segmentation?

Needs-based segmentation is the process of identifying groups of people based on their shared experience of a specific problem or need.

Like other forms of customer segmentation, it aims to identify factors that can be used to divide people into different groups so that they can be described and targeted separately. It’s common for people to experience multiple needs that you’ll use to create segments, so it’s worth considering needs-based segmentation as a way of dividing people into groups based on their highest priority need (the problem they are most intent on solving or are experiencing the most impact from).

The Things That People Get Wrong About Needs-Based Segmentation

Having read every article that ranks on the first few pages of Google, there are a bunch of common things that people get wrong about needs-based segmentation:

The people who write articles about needs-based segmentation typically have no idea how to actually do it. This might seem like an absurd claim, but only 2 articles offered any recommendations on running your own needs-based segmentation projects. Every other article is just a sales piece for their research agency.

Needs-based segmentation doesn’t need to be prohibitively expensive or crazy complicated. The only companies that tend to commission needs-based segmentation projects today are large enterprises and they often have to rely on the results for 2-5 years because of the exorbitant price tag involved. But, as this article will demonstrate, needs-based segmentation can be done reliably by you without spending over $100k in the process.

Needs-based segmentation isn’t reliable unless it has both qualitative and quantitative data. Understanding people’s needs is inherently people-based; you need to interview people, collect quotes from them, and dive deep into their perspectives to understand the range of problems and pain points they face. However, unless you can layer measurable data over those needs, you’ll be left guessing as to which are the most important to them and how many people are affected by each one.

Needs-based segmentation cannot exist on its own. Unless you’re dealing with academic theory, you’re going to need to combine a needs-based approach with another form of segmentation in order for your segments to be identifiable and addressable. So let’s quickly cover the main types of segmentation we can combine this approach with...

What are the 3 types of customer segmentation?

A Priori Segmentation

This confusing Latin term simply means “stuff you already know”. It’s a broad umbrella term for the types of data you’ve likely already got on your target customers, such as Demographic (age, gender, education, job title), Geographic (continent, country, urban vs. rural), Psychographic (lifestyle, interests, social status), Firmographic (company size, industry category, growth), or Behavioral (purchase frequency, content engagement, customer journey stage) data.Value-Based Segmentation

Not to be confused with people’s personal values (which fall under ‘psychographic’), value in this case means financial value. Data used for value-based segmentation should align with the way you measure revenue in your company, such as monthly recurring revenue (MRR), average purchase size, the number of seats associated with their account, their average product usage per billing period, etc.Needs-Based Segmentation

Unlike the other two segmentation types which group customers based on visible data points (‘descriptive data’) that likely have little to do with their reason for buying or the value they derive from your product, needs-based segmentation aims to understand the pain points, problems, motivations, needs or ambitions that are driving customer behavior. It is the strongest (and most difficult, until now) form of segmentation that you can use to inform your team or company strategy.

The 2 Different Approaches for Needs-Based Segmentation

As already mentioned, needs-based segmentation is never used as the only method when creating customer segments. If you grouped people by needs without layering any descriptive data on top, then you would have no way to identify and target the segments you’ve created.

Instead, we need to combine needs-based segmentation with one of the descriptive segmentation types using one of the following approaches:

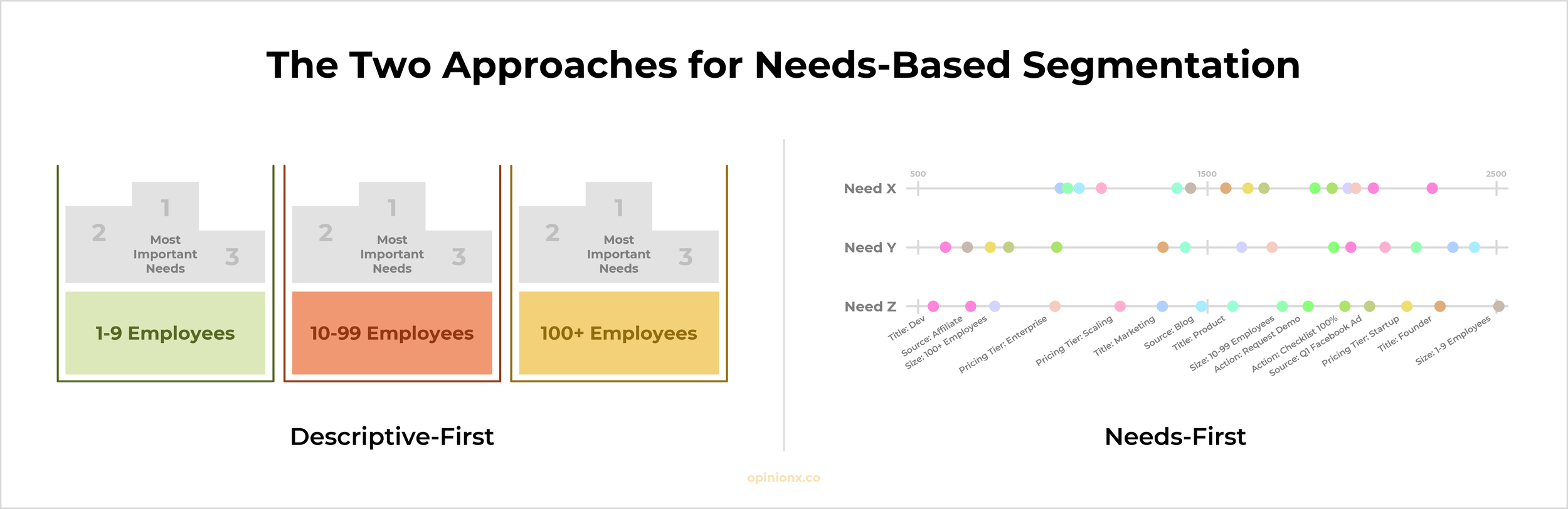

1. Descriptive-First

We start by first using the descriptive data we have available like demographics, firmographics or customer value to create buckets to group people into, and then we identify the most important needs that each group experiences.

2. Needs-First

This is like the reverse of the above option; you identify all the different needs within your sample population first and then use discriminant analysis to see which descriptive data point has the strongest relationship with each need.

^ Click here to view this graphic in full screen

Descriptive-First is a much less complicated approach mathematically and will be the approach I use for this guide. However, I’m planning to write a separate guide for the Needs-First approach at a later stage, which I will share in our newsletter. Subscribe here to receive that guide once it’s ready.

The 7 Step Process to Creating Needs-Based Customer Segments

Descriptive Distinctions

Value Buckets

Activity of Focus

Statement Storming

Stack Ranking

Crowdsource Your Gaps

Filter By Descriptor

Note: as mentioned before, I’ll be explaining these 7-steps using examples and screenshots from OpinionX as it’s a tool built specifically for ranking people’s most important needs and creating needs-based segments, however feel free to apply these tips on any tool of your choosing.

Step #1: Descriptive Distinctions

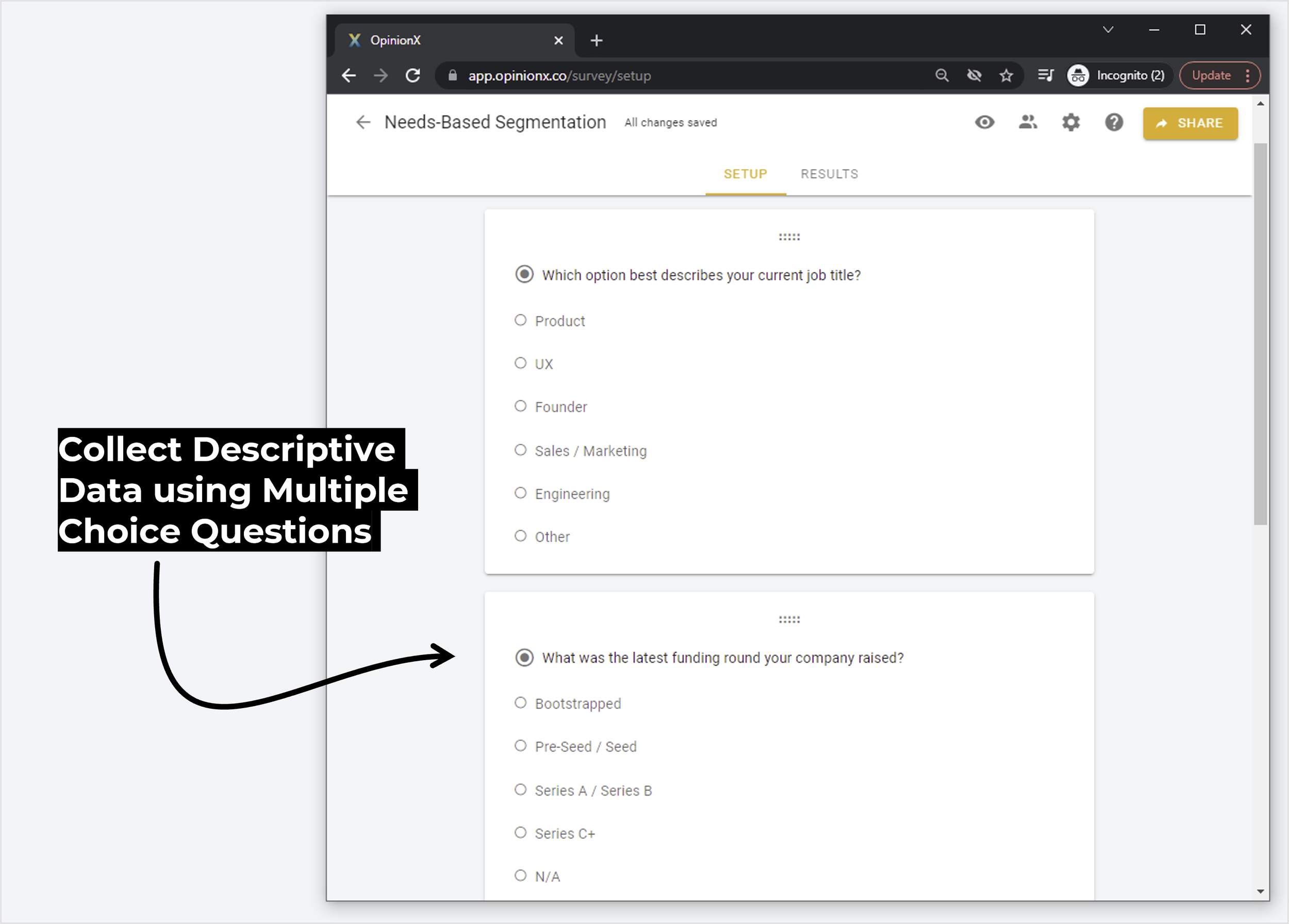

The best place to start when building a needs-based segmentation project is to think about the ways that you already describe your ideal customer or target user. For B2C products, you likely have a bunch of demographic criteria for what makes a good customer like age, gender, and family status. For B2B products, you likely use a combination of firmographics like company industry and funding stage together with some ‘professional demographics’ like job title and seniority level.

At OpinionX, we’ve found that the two data points most predictive of good customers for us are job title and company funding stage. We focus on scaling companies around the Series A & B funding stages because they tend to have the perfect use case for our product (quickly expanding into new territories, product categories and customer segments where they need robust data quickly to inform prioritization decisions). Within those scaling companies, we’ve found that people working in product and UX roles are most likely to turn into happy customers that keep coming back to us.

If you already have users/customers, splitting your CRM into two lists, ‘happy customers’ and ‘churned leads’, and then describing those two groups using broad demographic or firmographic terms can help you to identify some potential descriptive data to test in the later steps.

When gathering the descriptive data that we’ll use to create segments, it’s worth using multiple-choice questions to filter out unwanted data so that we can ensure our segments are homogenous when we get to analysis later.

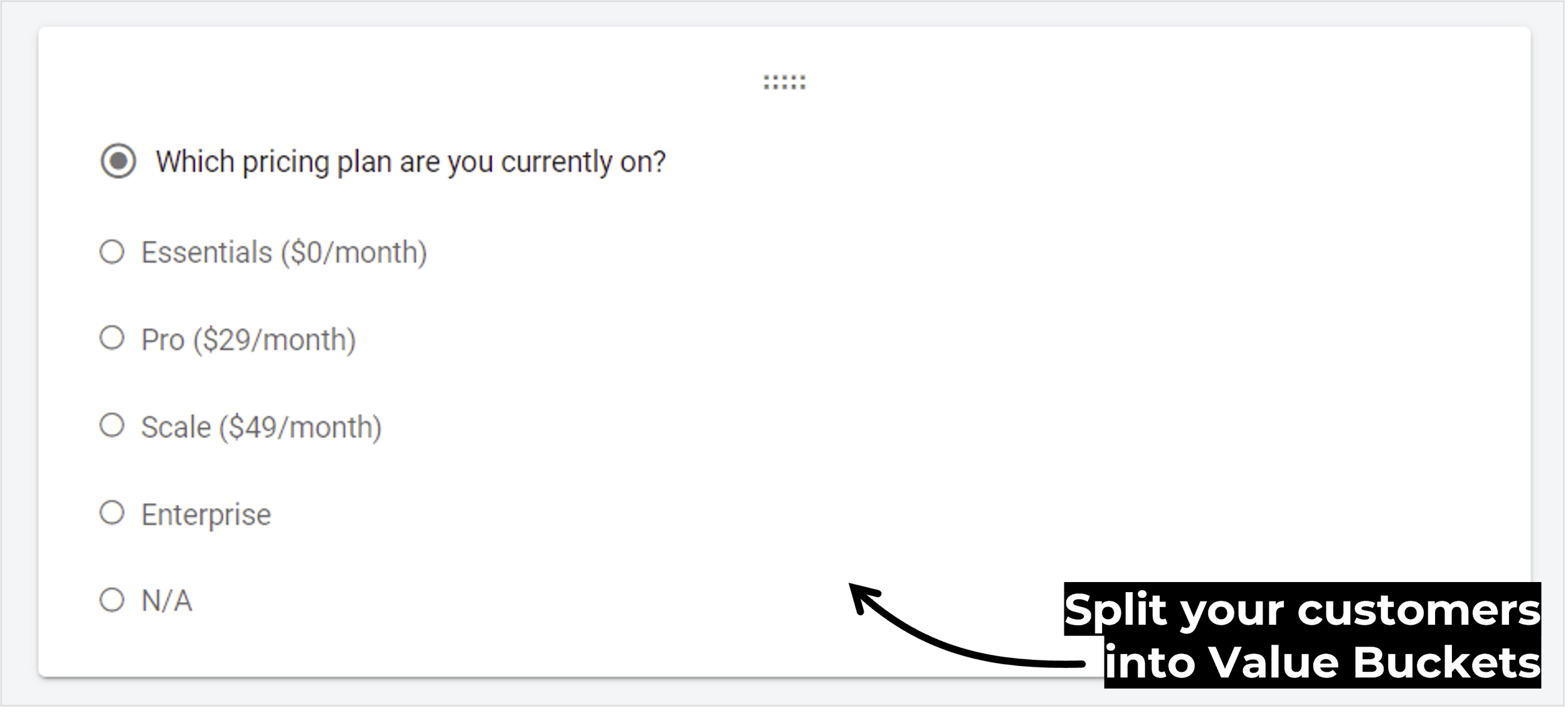

Step #2: Value Buckets

How do you group your customers into different buckets based on their financial value? (If you are doing needs-based segmentation for a product/service that does not yet have customers, skip ahead to Step #3). The answer to this question is usually pretty easy — one look at your pricing page should give you the answer.

If you use tiered monthly subscriptions (like we do at OpinionX), then you’ll want to add another segmenting question like “Which pricing plan are you currently on?”. Later, when you get to the analysis step, having this data will allow you to see what the top needs are according to each of your price cohorts.

If your pricing model isn’t based on monthly subscriptions, just use the best grouping method you can which reflects how you measure revenue per customer. If you’re an ecommerce business, you might use average order value or purchase frequency. If you’re an infrastructure platform you might look at usage-based buckets like how many credits someone spends per month. Whatever you use, make sure it reflects your pricing model.

Step #3: Activity of Focus

If we want to understand a person’s highest priority needs, we must first give them context about what set of needs they should consider. If I asked you “What is your biggest pain in work each week?”, I’d likely get a very different answer to the question “What is your biggest frustration when it comes to managing your CRM?”.

There are a bunch of different ways that you can set the ‘Activity of Focus’ when researching people’s most important needs:

Product Category: focusing on competitive alternatives to understand frustrations and shortcomings (eg. frustrations with CRMs).

Occasion: using a specific event or recurring circumstance to understand the needs that extend beyond product offerings (eg. challenges that arise at the financial year-end).

Use Case: understanding the priorities a customer has throughout the use case that you target (eg. difficulties running performance reviews).

Existing Usage: engaging existing customers to understand the needs that your product addresses for them or why they decided to give your product a try in the first place.

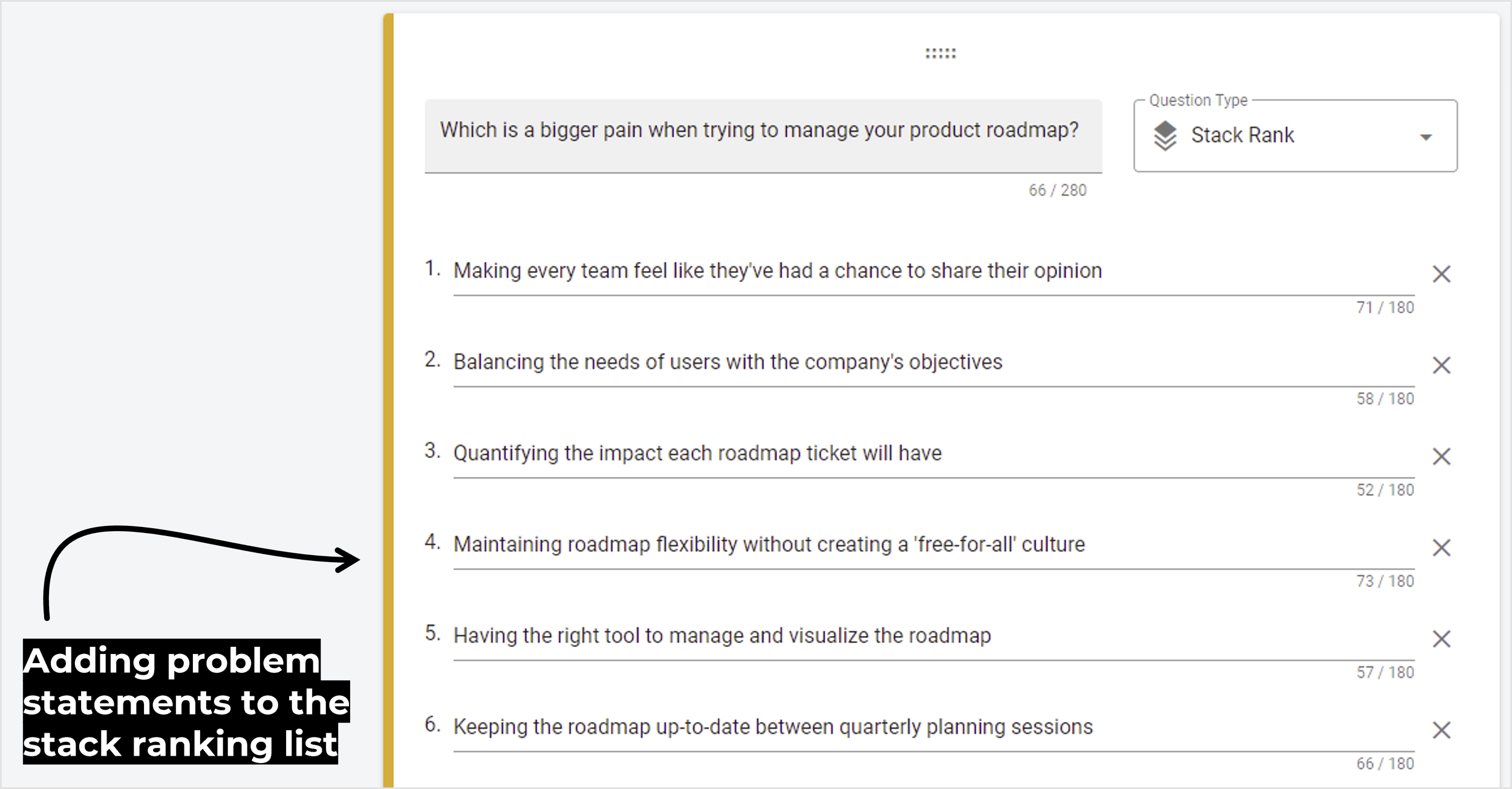

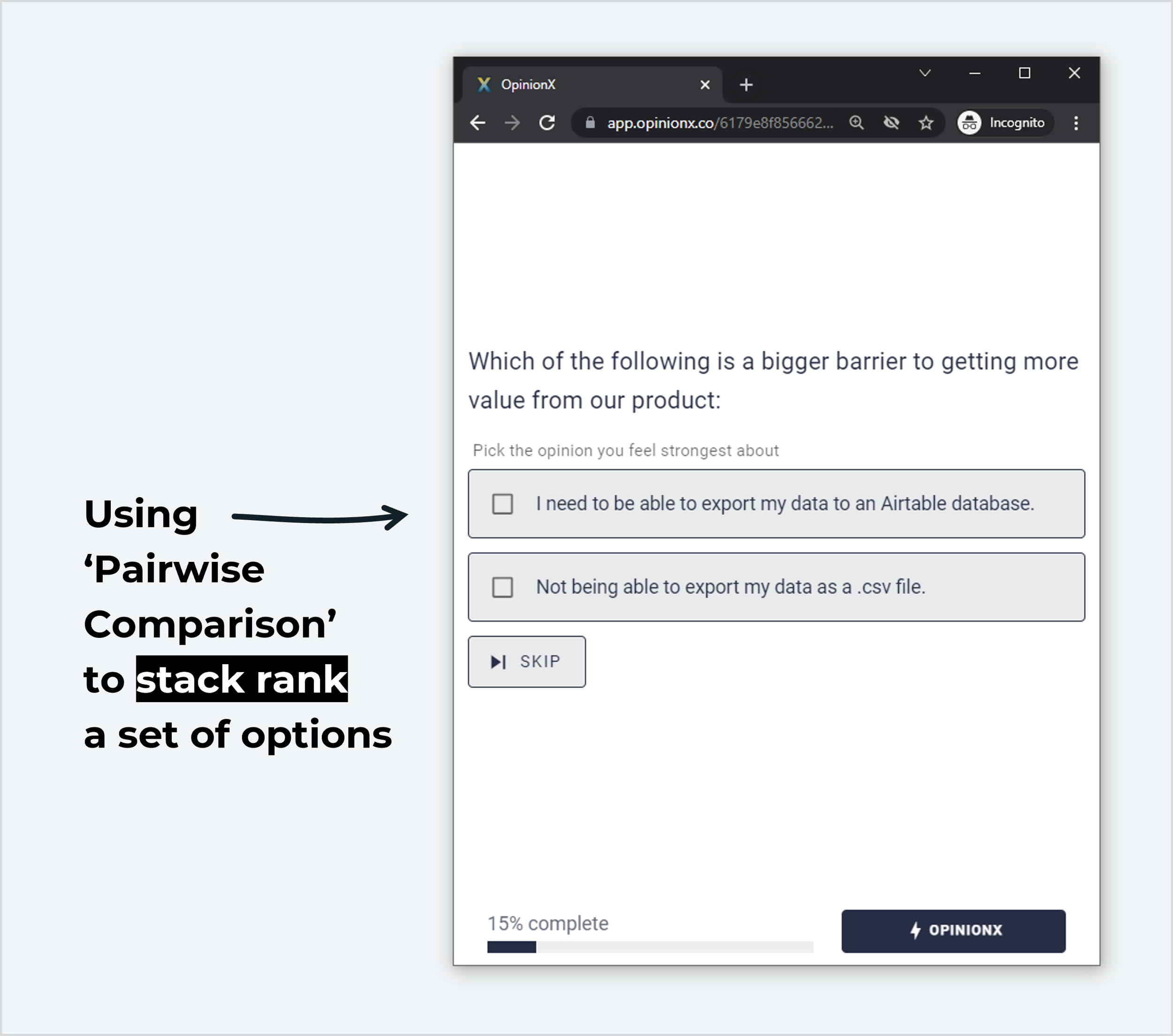

As you can see throughout the above examples, we need to turn our ‘activity of focus’ into a question. To rank the needs of each segment, we’re going to use an approach called Pairwise Comparison (showing someone a pair of needs statements and asking them to pick the one that they feel strongest about — explained further in Step #6). With that in mind, you can use a generic question format like: “Which is a bigger pain when trying to manage your product roadmap?”. Replace the underlined part with whatever your ‘activity of focus’ is.

Step #4: Statement Storming

Needs-based segmentation always starts with qualitative research roots. To segment by needs, you first need to know what people’s needs are. The ‘Statement Storming’ step simply means shortlisting the needs that surfaced most during your discovery research; quotes from user interviews and onboarding calls, phrases from feature requests and customer quotes, insights secondary research and observation, etc.

Since user needs are typically one layer of abstraction above problem statements or pain points, I find that it’s easier for people to articulate and compare problems rather than needs. I generally aim for 10-30 problem statements, including problems experienced by my target customer during the activity of focus that I’m not aiming to solve (these are used to understand the relative importance of the needs you’re addressing — these are ‘peripheral problem statements’).

Four rules I tend to follow when writing problem statements:

Short & Concise: Keep it under 100 characters ideally.

One Statement = One Problem: Don’t include multiple problems in a statement as you won’t be able to infer any insights from the results afterwards.

1st Person Perspective: Write from the respondent’s perspective rather than your perspective, such as “I find it difficult to...” instead of “Product Managers find it difficult to...”.

No Personal Info: If you include too much detail, such as specific names or places, you will tarnish your results by forcing participants to skip or exit the research project prematurely.

Note: I’m planning to create a full article on writing problem statements and needs statements in the coming weeks. When it’s ready I’ll update this paragraph to include a link to it. If you want to be notified, subscribe to our newsletter to be the first to read it:

Step #5: Stack Ranking

Stack ranking is a research method that compares pairs of statements from a list and ranks them in order of highest importance according to participants' votes. OpinionX can rank anything from 4 to 4,000 statements according to thousands of participants (all while only requiring 60 seconds from each of them).

Traditional surveys use drag-and-drop ranking for simple questions with 3-8 options. But when you’re dealing with a big list of options, like with problem ranking, you need an easier way to rank a list of 20+ or 100+ options. That’s why OpinionX selects 10 pairs of statements for participants to pick between (called Pairwise Comparison) and then uses an advanced rating system to score every statement.

If you’re working at a very small scale of 1-5 people, this process of voting can be carried out manually during user interviews through a ‘card sorting’ style test, however the data grows very quickly and is difficult to compare and aggregate.

Stack ranking is the easiest way to identify the most important needs of any group of people at scale in a robust, reliable and repeatable manner. There is no mathematical analysis required on OpinionX — the system handles all of the data science and gives you the results in a simple table ranked from 1st Place to Last Place.

Step #6: Crowdsource Your Gaps

Even the most thorough discovery research will likely miss some of the most important problem statements. It’s important that you remain open-minded during the participant engagement portion of this process so that you can spot missing problem statements that you should add to your voting list.

OpinionX has a feature called ‘Open-Response blocks’ which allow participants to submit new statements which you can instantly add to your Stack Ranking list (aka a ‘crowdsourced opinion’).

I analyzed every successful stack ranking survey carried out in Q2 2021 and found that a crowdsourced opinion finished in the top three most important statements in 81% of stack ranking surveys. That should really make it clear that this step is SUPER important — keep an eye out for missing statements and adapt your list as you go.

Step #7: Filter By Descriptor

In the steps I’ve just outlined, we have (i) used multiple-choice questions to assign demographics to each participant which we will later use to filter participants into segments, (ii) created a stack ranking question and list which will rank every problem statement by importance, and (iii) created a ‘suggestions box’ to crowdsource key missing statements.

OpinionX automatically compares and ranks all of the problem statements, helping you to uncover the overall highest priority needs amongst the whole group of participants. However, what we’re interested in here is segmentation.

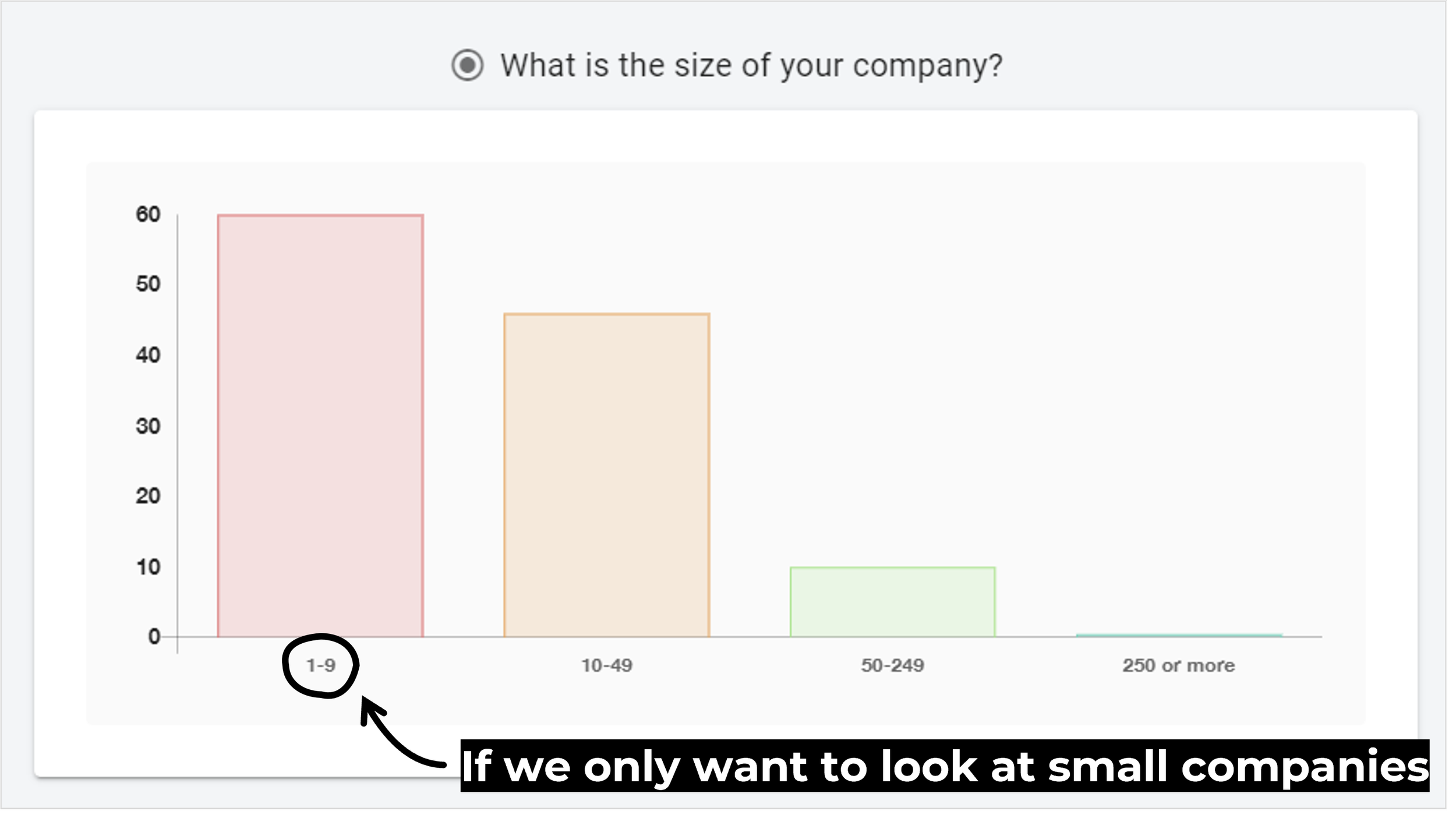

Let’s imagine that we want to filter the stack rank results to look only at the respondents that are from a company with a headcount below 10 people:

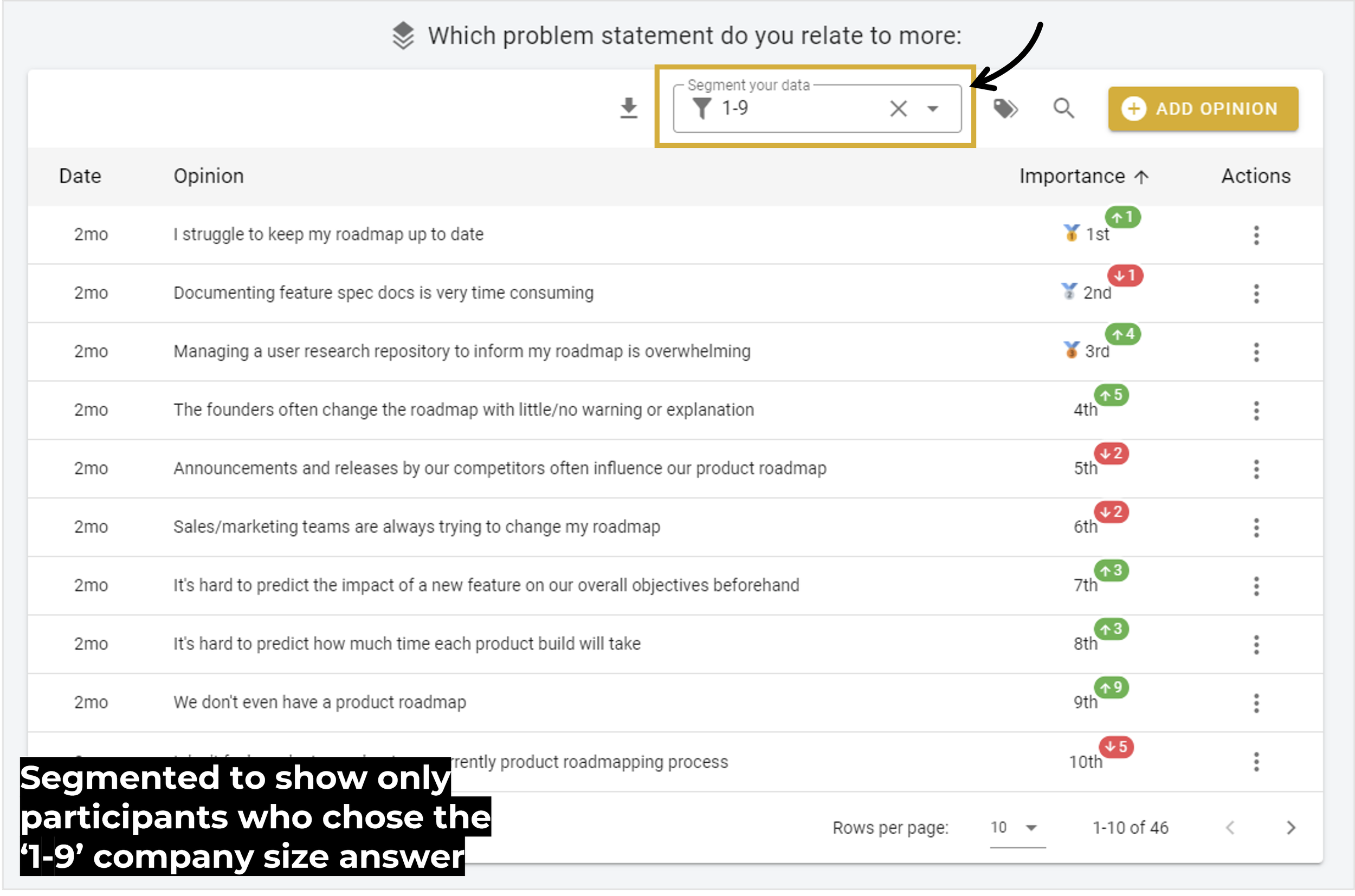

To create that segment and analyze their specific top priority needs, all we have to do is click the Segmentation Filter on the Stack Rank results table and click the ‘1-9’ option:

^ In the above screenshot from OpinionX, the small red and green tiles show the change in ranking of each statement for this segment compared to that statement’s ranking for all participants.

As you can see, this approach allows us to take any descriptive data point (whether that’s demographic, firmographic or financial data) and identify the most important needs or problems according to that group of people, all in just one click.

With this approach, without any calculations, spreadsheets or math, we can see what need our product solves for our top tier customers, for the job title that drives the largest portion of sign-ups, and for the company size that are most likely to convert to paying customers.

These steps tick every requirement of a needs-based segmentation project: it combines qualitative quotes with quantitative statistics, the process can scale to any number of statements or participants, it requires only 1-2 minutes from each participant, it combines needs-based results with descriptive data so that your results are actionable, and — most importantly — it is based on rigorously tried-and-tested data science methodologies.

Real-World Example of Needs-Based Segmentation in Action

Thousands of gyms around the world, from small family studios to national franchises, use Glofox to schedule classes, manage memberships, track attendance rates, automate payments, and more.

Francisco Ribeiro, a Product Manager at Glofox, was working on a brand new feature for the Glofox platform during the summer of 2021 and had already conducted a bunch of user interviews to understand the customer need that this new feature would address. But there was a problem; Francisco couldn’t spot a clear pattern in the needs that customers were telling him about during these interviews.

In one interview, a customer would complain about not being able to track engagement with their members and then the next interviewee would say that they have no problem tracking engagement, instead their main challenge was knowing whether those members were churning or not.

When we first talked to Francisco, he was in the process of taking a big step back and had recognized that he was dealing with some frustrating inconsistencies. He decided to run a quick needs-based segmentation project on OpinionX to add some measurable data to this unclear picture. By the end of that same week, Francisco was staring right at the root of the problem — the highest impact problem was completely dependent on the size of the customer!

Using OpinionX to stack rank his customers’ needs and split them into segments based on the size of their gym operations, Francisco calculated Glofox’s bottom-line financial impact for each segment’s top problem to understand which one to focus on solving first. With this information on hand, he was able to inform his roadmap prioritization with real data and could easily explain his rationale to the rest of his team.

Use Cases for Needs-Based Segmentation

Validation

Proving that your idea tackles a burning pain point for a defined group of people.

Positioning

Defining how your product/service will be a leader at addressing a need that a well-defined set of customers cares a lot about.

Onboarding

Delivering a personalized UX for new users by understanding the exact need that each segment is trying to address by signing up for your product/service.

Prioritization

Identifying the most important problems to solve next for your highest priority customers so that you’re always delivering the highest impact roadmap.

Contextualizing

Combining ideas with measurable data to help nudge your team out of decision paralysis.

Sales

Understanding the core needs that drive your best converting customers so that you can deliver the right message to the perfect lead at the right time.

Marketing

Building personas that are informed by real quantitative data rather than internal assumptions and fictional storytelling.

Retention

Discovering the impact that your product/service delivers for your best customers so that you can improve retention amongst new conversions.

Putting this guide into action

Needs-based segmentation doesn’t need to be a daunting task reserved for specialist data scientists and the most expensive market research agencies. By using some simple quantitative methods like stack ranking and leveraging your existing descriptive data, you can create needs-based segments that are based on real data that you can use to power every aspect of your startup or product strategy.

OpinionX is the only tool that’s purpose-built for stack ranking people’s needs and creating needs-based segments. The best part? OpinionX is completely free with no limit on the number of projects you can run. Create your needs-based segmentation project on OpinionX for free today or grab a slot in my calendar if you’d like a free needs-based segmentation planning session.