A Practical Guide to Market Simulators in Conjoint Analysis Surveys

Product leaders are constantly asking “what if” questions like:

What would happen if we moved this feature to a higher-priced plan?

What would happen to overall revenue if we raised our prices?

What would happen to conversion if we launch a ‘lite’ tier?

Most teams answer these with gut-feel assumptions, internal debates, or quick back-of-the-envelope calculations — even though there’s a research method designed specifically for answering questions like these. It’s based on real data, it doesn’t require any advanced statistical training, and it can be applied to a wide range of product and pricing scenarios.

That method is called a market simulator.

A market simulator shows how a group of customers would choose between different hypothetical products. It uses each survey respondent’s individual preferences to predict their choice and then aggregates those choices to estimate overall demand.

Market simulators are one of the most powerful and practical ways that teams analyze conjoint survey results. This guide explains how preference share simulators work, what they look like in action, when they’re most useful, and how to run them (without ever needing to touch a spreadsheet).

Contents:

A market simulator is built on top of conjoint analysis survey results. Before we talk about simulators, let’s quickly look at how conjoint works.

— — —

What is Conjoint Analysis? (Quick Overview)

Conjoint analysis measures what product attributes matter most to customers when they’re considering a set of potential products to buy.

Instead of asking people “how important is price to you?” or “how much storage do you want?”, a conjoint survey shows people different versions of a product and tracks what they pick to figure out the product attributes they actually care about most.

Those products all share the same categories (like price, seats, storage), but the specific option shown within each category is randomized (eg. 20GB, 50GB, 100GB for the ‘storage’ category). Every time the survey respondent picks the product they like most, the options are randomized again, and the respondent is asked to vote on a new set of profiles.

Recording of a conjoint analysis survey on OpinionX

Conjoint surveys tell you which categories matter most to people and, within each category, which options they prefer most. If this is your first introduction to conjoint surveys, I recommend pausing here and reading my beginners’ guide to conjoint analysis before continuing.

Screenshot of conjoint survey results on OpinionX

— — —

How Do Market Simulators Work?

To understand how a conjoint simulator works, it helps to break it down into three simple steps:

Scenario Setup

Individual Preferences

Aggregated Predictions

1. Scenario Setup

A conjoint simulator predicts what percentage of respondents would choose each profile in a hypothetical scenario.

So the first step is to define that scenario. You need to create two or more profiles for the simulator to run against each other. You create a profile by selecting one option from each category in your conjoint study.

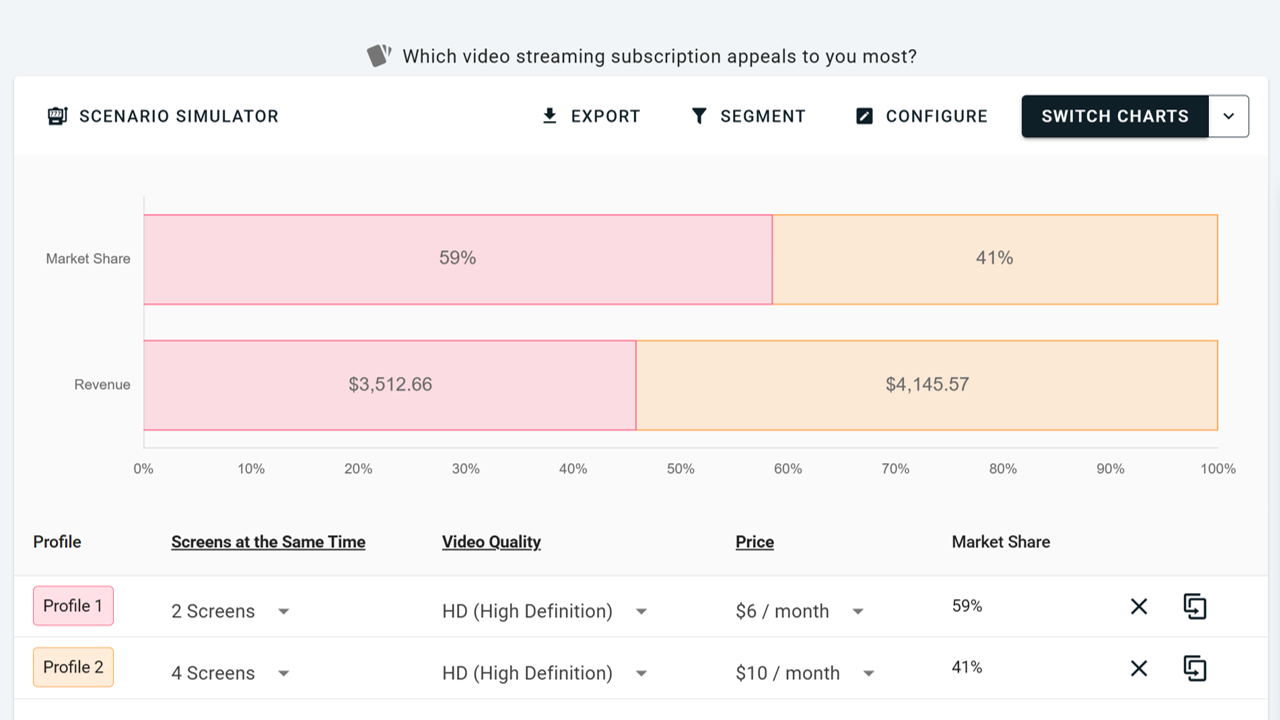

For example, in the GIF below, you can see the simulator for a conjoint survey where the question was “Which video streaming subscription appeals to you most?”. The categories in this example are: (i) Screens at the same time, (ii) Video quality, and (iii) Price per month. Each row is one profile, and whenever an option is changed using one of the dropdown buttons, the simulator re-runs automatically.

Ok, that may seem like the entire story, but it’s worth digging a little deeper to understand how the simulator is generating these results.

2. Individual Preferences

Once a respondent completes your conjoint survey, their votes have automatically been turned into a preference score (sometimes called a utility score) for every option shown in the survey, showing which options they liked and which they disliked.

Once your scenario is defined, the simulator uses these preference scores to figure out which profile the respondent would prefer. The simulator adds together the preference scores for each option in Profile 1, repeats this process for Profile 2, and then compares these total profile scores to see which is higher.

This simple approach is repeated for every participant in your survey at an individual level, not using overall average preference scores. That’s precisely what makes the simulator so useful — it respects differences in preferences across respondents instead of assuming everyone thinks the same way.

3. Aggregated Predictions

After calculating each individual’s predicted choice, the simulator aggregates the results. For example, imagine your conjoint survey had 1000 participants in total. If the simulator calculates that 590 people would pick profile 1, then Profile 1 is given 59% market share on the simulator:

This “59%” number is commonly referred to as preference share or simulator market share, which is why it’s often called a market share simulator. It’s important to be clear about what this preference share means…

A conjoint simulator is not a perfect real-world forecast. Actual purchase behavior is influenced by loads of different external factors like awareness, distribution, competitor reactions, brand trust, habit, and even mood, which can’t easily be factored into the simulation. Despite this, it is extremely effective for comparing options on a level playing field and understanding relative preference between different product combinations.

— — —

Conjoint Simulator Use Cases

Simulators are ideal whenever your team is debating “Should we do A or B here?”. Here are five common use cases where a conjoint simulator can help you make a better-informed decision:

1. New Pricing Tier Launch

→ Will adding a mid-tier plan attract price-sensitive users without cannibalizing premium revenue?

You can simulate (i) current plans only, (ii) current plans with a new mid-tier, and (iii) a redesigned pricing ladder, to compare market share and revenue impact for each approach.

2. Feature Paywall

→ Which features should stay free, move behind a paywall, or become paid add-ons?

Instead of debating internally, test multiple bundling strategies to see which combination drives the strongest preference from customers.

3. Price Increase

→ Will a price increase grow revenue or reduce it through higher churn?

By simulating current pricing vs proposed pricing vs opt-out/rejection, you can estimate (i) change in market share, (ii) change in revenue, and (iii) change in churn.

4. Competitive Repositioning

→ How does our offer compare to competitors?

Run a conjoint survey with your offering and the features/prices your competitors use, then simulate how customers choose between them. This approach can help you see how much brand perception impacts customers versus value from features or price.

5. Segmentation strategy

→ Do different customer segments value our plans differently?

Because simulators operate at the respondent level, you can filter your data by segment (eg. hiding freemium users to focus only on premium customers) and the simulation will automatically rerun with one group. This helps you uncover opportunities for differentiated pricing or packaging. And on OpinionX, your simulator and all your results can be filtered in one click.

— — —

Revenue Simulator

Market share is useful, but revenue is usually what leadership cares about most.

You’ve likely noticed that the simulator screenshots I’ve been including show more than just the percentage of survey participant who would pick each profile — they also show how much revenue each profile would generate based on its projected market share.

OpinionX’s Revenue Simulator reveals how much revenue each profile would generate by multiplying the profile’s price by its market share along with an assumption of 1000 hypothetical customers. For example, if a product costs $8 and has 24% market share, it would be $8 x 0.24 x 1000 customers for a total of $1920 in potential revenue.

While conjoint results can sometimes feel intuitive on the surface, like people preferring low prices more than high prices, combining price and market share data like this in a simulator can reveal unexpected insights.

For example, in the screenshot below, Profile 2’s higher price means it generates 18% more revenue overall, despite Profile 1 having 18% higher market share to begin with:

Churn Simulator

Another useful extension to the conjoint simulator is to incorporate rejection data, which is when respondents select None of the Above during conjoint voting

Including a “None of the Above” button allows you to measure which features or prices are most likely to drive people to reject a product. Including this data in your simulator makes it a lot more realistic — instead of forcing everyone to pick a profile, even when they don’t like them, you can clearly see whether you’re offering something genuinely unappealing or problematic.

Rejection data is particularly valuable when modelling pricing changes because it acts as an indicator for churn. For example, you can run a simulation with your current pricing and another one with your proposed pricing changes. If the percentage of respondents rejecting the proposed changes increases significantly, it’s a signal that you could see a spike in churn if you pursue that model.

Let’s bring this all to life with a practical user research example…

— — —

[Case Study] Conjoint Simulator Research Project

Florafi is a B2C mobile app that helps plant owners to grow greener homes with watering reminders, habit tracking, and smart care tips tailored by plant species, age, and environment.

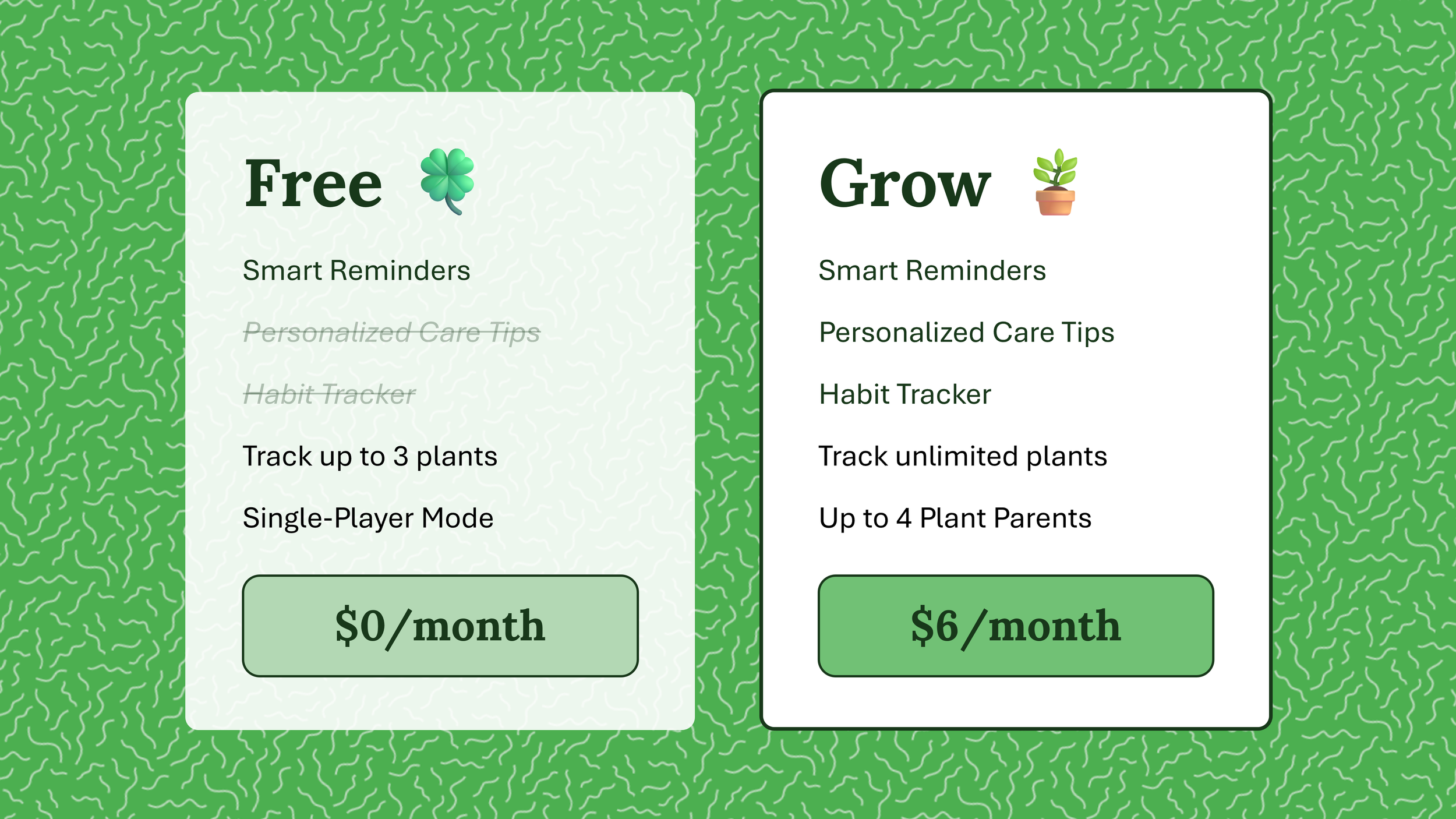

Until now, Florafi has kept pricing pretty simple:

The free reminders tool helps you start taking better care of up to three plants.

For $6/month, the Grow plan unlocks shared accounts, a habit tracker, and smart care tips for unlimited plants.

Here’s what that looked like:

The Big Product Launch: Dr. Rooty

After six months of development, Florafi was preparing to launch their most ambitious feature yet — an AI-powered plant expert called Dr Rooty.

Dr Rooty diagnoses plant health problems, suggests infestation mitigation plans, explains unexpected health changes, and adapts its care plan automatically based on a medical history it maintains for each plant.

For the Florafi team, Dr Rooty was the biggest feature launch they had ever worked on. Beta testing showed strong adoption, retention, and perceived value. The team were confident that the feature would be a success. What they weren’t confident about was how to price it.

They could make Dr Rooty an optional add-on, create a new higher premium tier centered around it, or tie it in with a price increase for all existing Grow tier customers. Their challenge was to figure out a pricing model that would maximize revenue without spiking churn…

Picking The Right Research Method

The Florafi team debated endlessly about the best approach. Every time they thought they had made a decision, they realised it only led to more questions about what customers really valued most, like collaboration, plant limits, or specific features.

As an early-stage startup, they didn’t have the resources to run large-scale pricing A/B tests inside the product. What they needed was a way to simulate pricing decisions before committing to a launch approach.

That’s when they decided to run a conjoint analysis survey.

Their conjoint survey could present users with different subscription plans made up of randomized feature combinations and prices. By analyzing which of the randomized plans users chose in the survey, they could measure:

How valuable Dr Rooty is relative to other features.

How sensitive customers are to price changes.

How much plant limits and collaboration matter.

But the real power wouldn’t just come from these survey results…

When someone completes a conjoint survey, their votes are automatically turned into preference scores to show what they care about most. You can plug this preference data into a conjoint simulator to see how customers would react to different pricing models.

Instead of their endless debates, the Florafi team could use a simulator like this to test their different pricing ideas in a virtual environment and roll out the strategy with the best result.

Conjoint Survey Design

With the research method identified, they jumped into survey design. Here’s the structure of the conjoint analysis survey they created:

Daily Care Reminders

- ✓

- ✕Personalized Care Tips

- ✓

- ✕Habit Tracker

- ✓

- ✕Dr. Rooty, AI Plant Expert

- ✓

- ✕Limit

- 3 plants

- 10 plants

- Unlimited plantsUsers

- 1 (Single-Player)

- 2 (Plant Parents)

- 4 (Plant Family)Price

- $0 / month

- $3 / month

- $6 / month

- $9 / month

They launched the survey using an in-app banner inviting users to participate.

Survey Results

Once responses started coming in, the team jumped straight to the simulator.

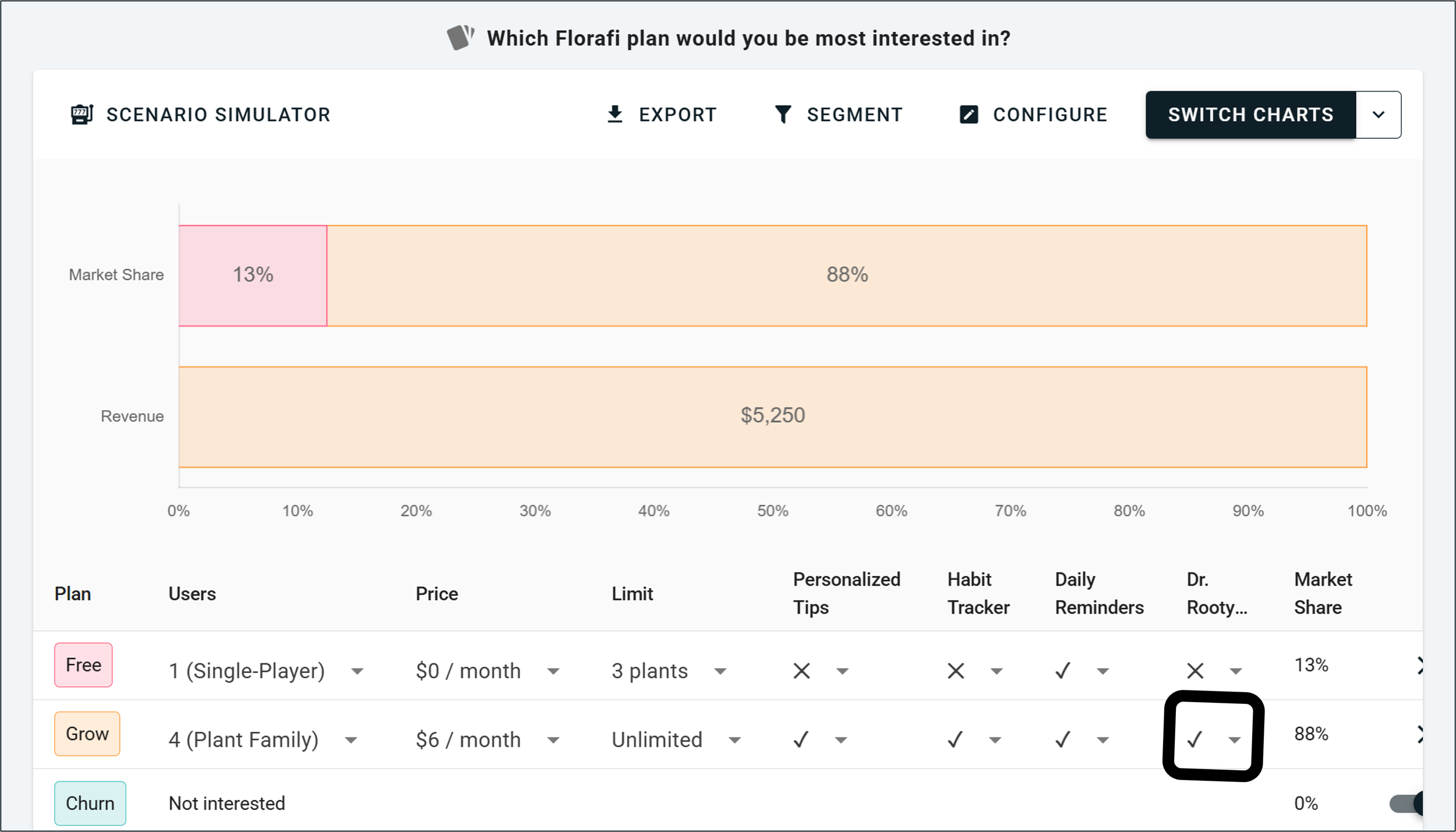

Scenario 1: Current Pricing

The first scenario they ran on the simulator was the existing pricing model (Free $0 + Grow $6). The result showed strong demand for the Grow tier, with around 7 out of 8 users preferring it over the Free tier in the simulation.

Scenario 2: Add Dr Rooty to Grow, No Price Change

Next, they added Dr Rooty to the $6 Grow plan to see if it would drive more upgrades from Free users. But premium adoption didn’t change. The beta test showed that Dr Rooty adds value, but it seemed it either wasn’t enough value to convert more free tier users, or those who value its addition are already on the paid plan.

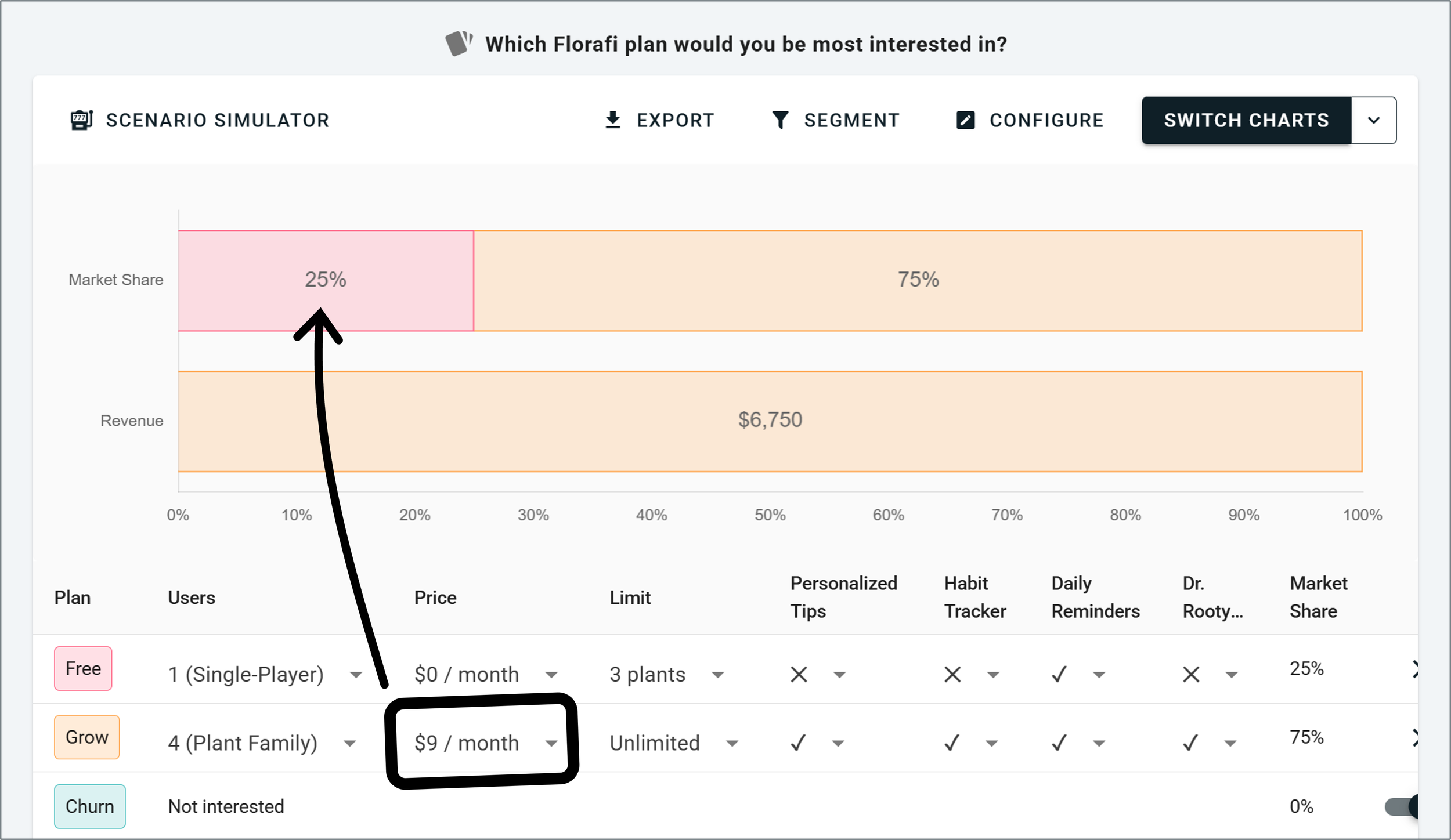

Scenario 3: Increase Grow to $9

What if they added Dr Rooty to Florafi’s Grow tier along with a price increase to $9/month? This increased revenue per customer by 29%, but downgrades also surged. The proportion of users on the free tier nearly doubled.

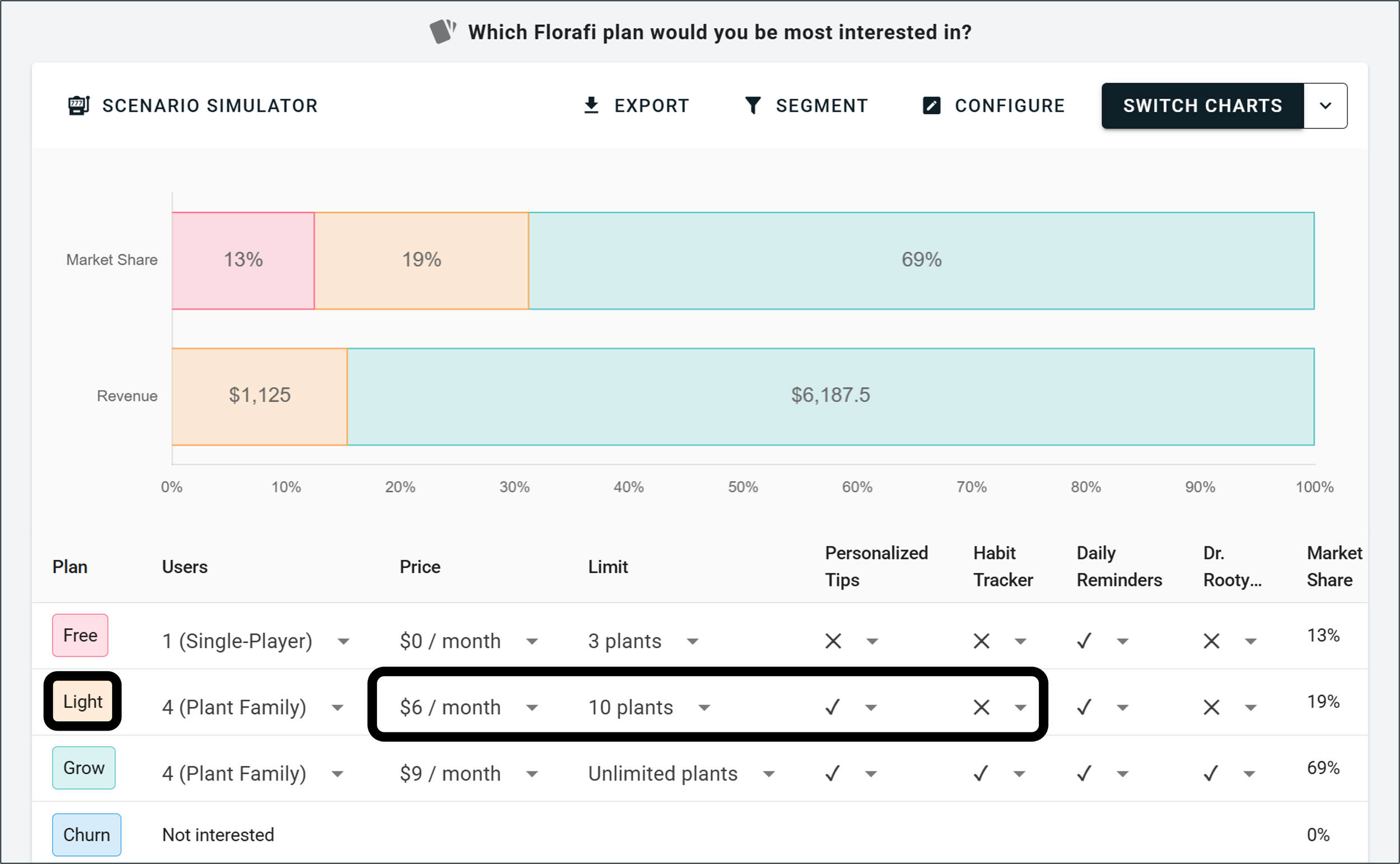

The Breakthrough: Middle Tier

After dozens of combinations to test different plant limits, collaboration seats, and prices, they found a breakthrough by adding a third tier in between Free and Grow:

The Grow tier would be increased to $9/month along with the new Dr Rooty feature. A new ‘Light’ tier was added at $6/month as a limited premium tier for price-sensitive users, giving them collaboration and some more functionality than the free tier for up to 10 plants.

This Free / Light / Grow approach offered existing $6/month Grow customers a soft landing to a price they were already familiar with paying without forcing them back to the free tier or into a hard churn.

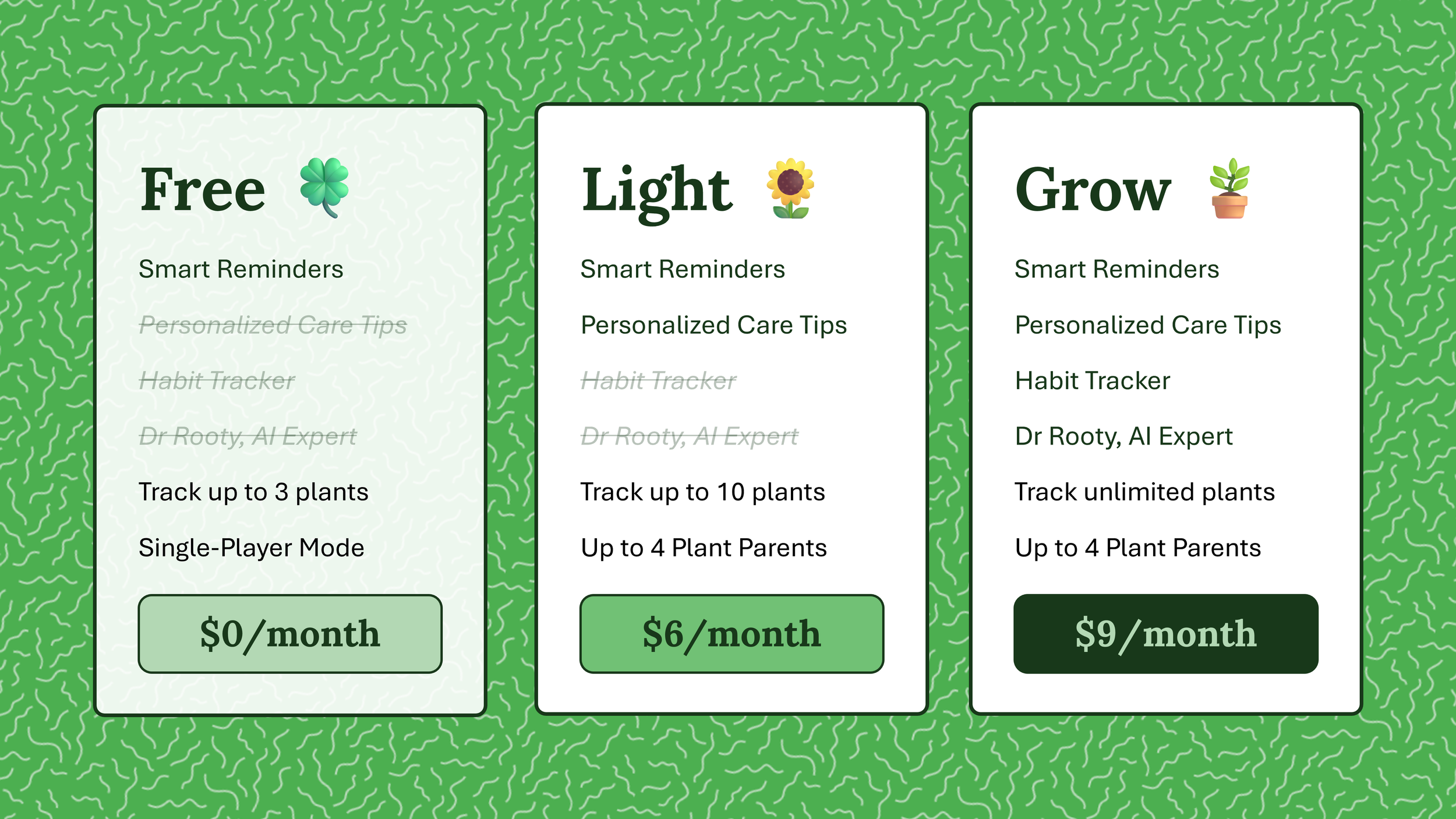

The Outcome

This three-tier model delivered:

APRU increased from $5.25 to $7.31 → a 39% increase compared to the original model.

No predicted increase in Free-tier share of userbase.

No increase in full rejection of any offering.

In other words, higher revenue, no extra churn, and better price segmentation.

And they figured this all out without having to change a single line of code.

— — —

Types of Conjoint Simulator

Not all conjoint simulators are built the same. Here’s a quick overview of common approaches, ranging from simple methods to the gold standard model used by the best researchers:

1. Aggregate Logit (Basic)

This simulator doesn’t check each individual respondent’s preferences. Instead, it just looks at the overall scores for everyone averaged together to predict how the typical customer might act.

2. Latent Class (Intermediate)

Groups respondents with similar voting patterns together and then runs the simulator against each of these groups. It’s more accurate than the ‘aggregate logit’ approach, but still sacrifices accuracy by not checking each person’s preferences individually.

3. Hierarchical Bayes (HB) → (Advanced)

Each respondent gets their own preference model, which the simulation uses to model behavior for each person individually and then aggregates all those outcomes to create a market share prediction. HB is the baseline standard in conjoint research and is the approach I used to explain how simulators work throughout this guide..

4. HB-Hamiltonian Monte Carlo → (Gold Standard)

Instead of assuming each respondent’s preferences are perfectly known, this method considers potential uncertainty by generating multiple possible versions of each respondent’s preferences. Then it simulates outcomes across these variations to produce more robust predictions. This reduces the potential overconfidence in HB models and makes the results more realistic.

The simulator screenshots in this guide are from OpinionX which uses the Hamiltonian Monte Carlo method on top of a ‘Hierarchical Bayes Multinomial Logit’ scoring model. HB-MNL-HMC is the gold standard of conjoint simulation and it’s available for free on OpinionX conjoint surveys.

— — —

Getting Started with Conjoint Simulators

OpinionX’s conjoint simulator is designed for people who are not specialist researchers. It removes all the manual work and complex terminology from conjoint research so that anyone can benefit from these advanced survey methods, regardless of their experience level.

Using simple dropdown menus, you can build product profiles and instantly simulate market share, revenue, and churn scenarios. This is all available on OpinionX’s free tier, which includes sample surveys and one-click templates to make it as easy as possible for you to test a market simulator for yourself. Premium customers even get prepaid consulting hours with a research expert to help them with survey setup and analysis.

Give it a try today by signing up for a free OpinionX account, no credit card required, and create your own conjoint analysis survey.

— — —

Did you enjoy this guide? Tens of thousands of Product Managers, UX Researchers, and Startup Founders subscribe to our newsletter The Full-Stack Researcher to get actionable user research advice like this delivered straight to their inbox:

About The Author:

Daniel Kyne is the Founder & CEO of OpinionX, the platform for advanced market research surveys. Hundreds of the world’s top product teams use OpinionX to measure their customers needs, map customer segments, and model purchase decisions — all inside this one easy-to-use platform for advanced surveys.

→ Try OpinionX for free today